Effects on Business Organization

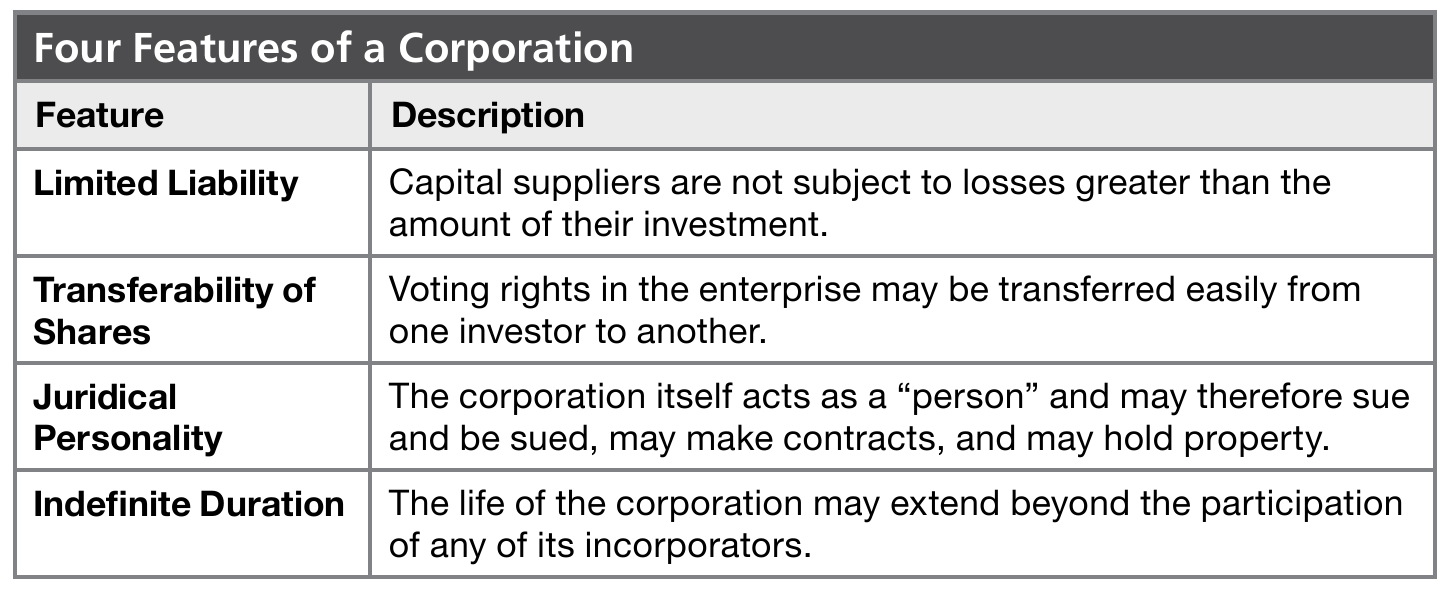

New ways of organizing businesses arose during the Industrial Revolution. Some manufacturers formed giant corporations in order to minimize risk. A corporation is a business chartered by a government as a legal entity owned by stockholders (individuals who buy partial ownership directly from the company when it is formed or later through a stock market). Stockholders might receive sums of money, known as dividends, from a corporation when it makes a profit. If a corporation experiences a loss or goes bankrupt, the stockholders are not liable for the losses. The most that stockholders can lose is what they paid for the stock in the first place.

Markets with One Seller Some corporations became so powerful that they could form a monopoly, control of a specific business and elimination of all competition. For example, Alfred Krupp of Essen, Germany, ran a gigantic company that used the Bessemer process, a more efficient way to produce steel, gaining a monopoly in the German steel industry. In the United States, John D. Rockefeller created a monopoly in the oil industry.

Companies Working Across Boundaries British-born Cecil Rhodes, founder of De Beers Diamonds, was an especially enthusiastic investor in a railroad project that was to stretch from Cape Town, in modern-day South Africa, to Cairo, Egypt. Connecting all of the British-held colonies with a transportation network could make governance easier and aid in conducting a war, if necessary. The project was never completed because Britain never gained control over all the land on which such a railroad was to be built. The overwhelming majority of railway workers in Africa were natives who were paid far lower wages than their European counterparts. Thus, railroad technology was a means of extracting as many resources as possible from subject lands while paying colonial laborers as little as possible.

De Beers was one of many transnational companies—those that operated across national boundaries—that emerged in the 19th century. For example, the Hong Kong and Shanghai Banking Corporation, a British-owned bank opened in its colony of Hong Kong in 1865, focused on finance, corporate investments, and global banking. The Unilever Corporation, a British and Dutch venture, focused on household goods—most famously, soap. By 1890 it had soap factories in Australia, Switzerland, the United States, and beyond. Unilever sourced the palm oil for its soaps first from British West Africa and later the Belgian Congo, where it operated huge plantations. Because these companies were transnational, they gained wealth and influence on a scale rarely approached before. (Connect: Defend or refute the claim— mercantilism was necessary for the eventual growth of transnational companies. See Topic 4.4.)

Corporations A sole proprietorship is a business owned by a single person, and a partnership is a small group of people who make all business decisions. A corporation differs from these two other major forms of business ownership in that a corporation is a more flexible structure for large-scale economic activity. It replaced the traditional system of a single entrepreneur engaging in high-risk business endeavors with a system of larger companies, collectively engaging in lower-risk efforts. By spreading risk, investments became much safer and more attractive.

Despite critics’ charges

that corporations undermined

individual responsibility, they became a common form of business organization. They eventually dominated many areas of business, from banking to manufacturing to providing services. With their growth, corporations gained great economic and political power. For example, the decision by a corporation about where to build a new factory could create thousands of new jobs for a community.

Banking and Finance Another way to reduce risk was through insurance, especially marine insurance. Lloyd’s of London, with beginnings in a coffee house where merchants and sailors went for the most reliable shipping news, helped establish the insurance industry. The number of banks rose as merchants and entrepreneurs looked for a reliable place to deposit money and to borrow it when needed to build a factory or hire workers for a new enterprise.